Tag Archives: Real Estate Snohomish County

The Home Connection- September

January Newsletter 2025

🎉✨ Happy New Year! 🎉✨

Welcome to 2025! 🏡 Whether you’re looking to dive into the real estate market, stay in the loop with the latest events, or pick up some fresh tips & tricks, this month’s newsletter has it all! 🌟 Get ready to kick off the year with exciting opportunities, expert insights, and a little inspiration to make 2025 your best year yet! 💪🔑 Let’s jump right in!

📚🍂 September Shenanigans: Back to School, Back to Home Sweet Home! 🏠🍁

As the kiddos head back to school and the leaves start to turn, it’s a great time to think about new beginnings—whether it’s finding a new home or making the most of your current one!

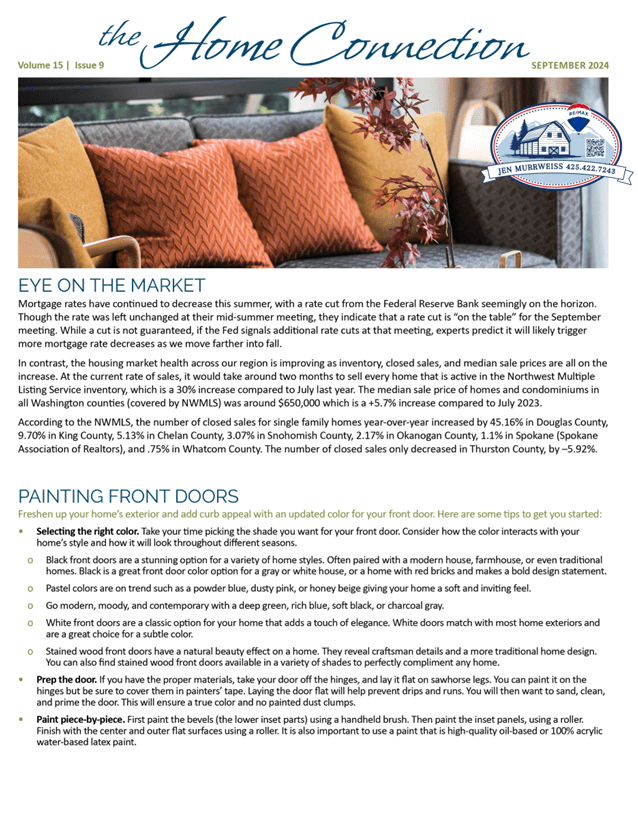

Here’s the scoop for September: Mortgage rates have been on a delightful downward trend this summer. While the Federal Reserve left rates unchanged at their mid-summer meeting, they’ve hinted that a rate cut could be on the horizon this month. 📉 If they decide to cut rates, it could mean even more favorable mortgage rates as we roll into fall.

So, while your little ones are hitting the books, why not consider making your real estate dreams a reality? Whether you’re looking to buy, sell, or just explore your options, I’m here to help you navigate the market with ease. 📚🏡

Looking forward to helping you turn your real estate goals into a reality! Reach out today, and let’s make this September the start of your next big adventure. 🌟

The Puget Sound Home Connection For March.

🌷🏡 Welcome to March!! As spring blooms around us, so does the real estate market! 🌱🏠 With the promise of warmer days ahead, it’s the perfect time to explore new listings and envision your dream home. 🌞💭 Keep an eye out for my market updates and expert tips to help you navigate the buying or selling process with ease. Plus, don’t miss out on exciting local events popping up across the county and beyond – because life’s too short to miss out on community fun! 🎉🌳 Let’s make March a month of new beginnings and exciting possibilities in the world of real estate! 🌟 🏘️✨

Puget Sounds The Home Connection for February

Hey there, lovely Washingtonians! 🌲❄️ As Cupid sprinkles love, let’s talk real estate magic in February! 🏡💖 The market is as enchanting as ever, with cozy homes waiting to embrace you. 🏠✨ Pro-tip: In this chilly weather, warm up your home’s curb appeal with seasonal touches! 🚗❤️ Exciting local events are blooming like spring flowers – stay tuned for sweet surprises! 🌷💝🌟 Let’s make your home dreams a reality! 🏠✨

Haven’t Already Winterized?

🌬️❄️ Winter is upon us, and while the season brings a magical snowscape, it also brings the risk of burst pipes, frozen woes, and unexpected home headaches! Don’t let the chill catch you off guard—warm up with these reminders on prepping your home for winter! 🏡✨

Because when it comes to your home, it’s better to be prepared than to face a chilly surprise! 🧤🔥 #WinterReadyHome #HomeSweetWarmHome

🏡✨ Your Puget Sound Home Deserves the Best! Annual Maintenance Checklist Inside. 🛠️🌲

As the beauty of the Puget Sound region unfolds around us, it’s the perfect time to ensure your home remains a sanctuary of comfort and style. 🏡✨ Our team understands the unique needs of Puget Sound homes, and we’ve curated an essential annual maintenance checklist just for you. 🛠️🌲 From the roof overhead to the roots in the ground, let’s embark on a journey of home care that keeps your investment in prime condition. Your home deserves the very best, and we’re here to guide you through every step. 🌟 If you have any questions or need local service recommendations, don’t hesitate to reach out. Your Puget Sound home is a gem, and together, let’s ensure it continues to shine bright!

Peanut Butter And Jelly Home Approval?

Getting preapproved before you start looking at homes is crucial for several reasons:

- Understanding Your Budget:

Preapproval helps you establish a clear budget range. By knowing how much a lender is willing to lend you, you can focus your home search on properties that align with your financial capacity. - Saves Time:

It streamlines the home-buying process. You won’t waste time considering homes that are beyond your financial reach. This efficiency is particularly valuable in a competitive real estate market. - Negotiation Power:

Sellers often prefer dealing with preapproved buyers because it indicates that you are a serious and qualified buyer. This can give you an edge in negotiations and make your offer more appealing. - Avoiding Disappointment:

Knowing your budget prevents the heartbreak of falling in love with a home only to find out later that it’s out of your financial reach. Preapproval sets realistic expectations. - Quick Response to Opportunities:

In a fast-paced market, having a preapproval letter allows you to act quickly when you find the right home. This can be a significant advantage, especially if there are multiple offers on a property. - Identifying Credit Issues:

The preapproval process involves a thorough examination of your credit history. If there are any issues, it gives you time to address them before making an offer on a home. - Clarifying Loan Options:

Preapproval provides insights into different loan options available to you. You can choose the type of loan that best suits your needs and financial situation. - Building Trust with Real Estate Professionals:

Real estate agents and sellers take preapproved buyers more seriously. It establishes you as a committed buyer, making the entire home-buying process smoother. - Smooth Closing Process:

Having your financing in order from the beginning helps ensure a smoother and quicker closing process. Delays related to financing issues can be minimized or avoided.

In summary, getting preapproved is a strategic step that not only gives you a clear financial picture but also positions you as a serious buyer in the real estate market. It enhances your ability to make informed decisions and increases your chances of securing the home you desire. If you are in the Puget Sound region reach out to me and I will guide you to the best lender associates based on you needs and we will work together to get you the perfect home that goes together beautfully. Just like peanut butter and jelly!

Fast-track Your Mortgage Payoff, Lower Your Retirement Debt

When retirement looms, financial stability is a gnawing concern for most people. Have I saved enough? What will inflation do to my nest egg? Will Social Security remain solvent? What are the health wildcards I haven’t planned for? As such, it’s wise to slash expenses and debt as much as possible, with the idea of entering retirement debt-free. For some, that means paying off the mortgage by accelerating their mortgage payoff.

Experian (https://bit.ly/3srAgU7) found that the average mortgage balance debt by generation in 2022 was:

Generation X (age 42-57): $274,406| Baby Boomers (58-76): $189,155 | Silent Generation (77+): $139,999

If you’re able to afford to put extra cash toward your mortgage, doing an early payoff can be a powerful strategy that not only cuts interest payments but lightens the financial and emotional load during retirement, bringing peace of mind, more money for hobbies, vacations, and funds for healthcare and long-term care expenses.

Still, before deciding, you must take a complete look at your financial picture to be sure that a faster payoff is the best way to achieve your goals and to understand the potential sacrifices and downsides of such a move.

Here are nine considerations.

1. Understand the risks. If you have a relatively low mortgage rate, could you miss out on higher returns on your money by putting the extra toward your mortgage? Will you miss out on mortgage interest deductions? By devoting money to your mortgage, you’re lowering your liquidity. Will that lack of liquidity adversely affect your other long-term goals or short-term needs? For example, are you hoping to give a chunk of money to help a child with a down payment or planning to pay some of your grandchild’s college costs?

2. Examine your debts. If you have credit cards, personal loans, and other obligations, paying those off is better before accelerating your mortgage payments. First, pay off debts with higher interest rates than your current mortgage because consumer debt typically carries higher interest rates than mortgages.

3. Understand your mortgage agreement. Read your agreement’s fine print and talk to your lender to be sure there aren’t prepayment penalties and that you’re allowed to make extra payments.

4. Calculate your savings. How quickly do you want to pay off your mortgage? Can you afford to shave five years or ten years off your mortgage? Use an online mortgage calculator to see how much principal you must pay every month or year to pay off a loan in a certain number of years and how much you’ll save with an early payoff. The savings can be significant. According to a NerdWallet calculator (https://bit.ly/45MhzZR), for example, if you took out a $300,000 30-year fixed loan at 5.5%, have ten years left, and decide to pay it off in five years, you’d have to pay an extra $206.75 monthly. The move would save $89,796.84 over the life of the loan.

5. Develop your repayment plan. Will you make an annual lump-sum payment or extra payments monthly or bi-weekly? One advantage of spreading the additional payments across the year and making bi-weekly payments is that you lower your principal balance each month, creating a smaller balance on which interest is calculated.

6. Look at your budget. How much extra money can you afford to put toward your mortgage? Where can you cut back? Also, consider the sacrifices you’ll need to make and decide if missing out on a vacation or cutting back on hobbies is worth it.

7. Don’t sacrifice retirement savings. Have an adequate emergency fund before shifting money to speed up your mortgage payoff. Also, be sure you’ll still be able to max out all your retirement vehicles like 401ks, Roth IRAs, and Health Savings Accounts and make catch-up contributions.

8. Pay the right way. Be sure to tell your mortgage holder that your extra payments will be applied to the loan principal, not the next month’s mortgage payment.

9. Talk to experts. Remember that there’s no one-size-fits-all approach with finances, so get advice from financial pros—your accountant and financial planner, for example—to understand the risks and the impact an early mortgage payoff would have on your other goals.