Category Archives: Financial Tips for Home buyers

Fast-track Your Mortgage Payoff, Lower Your Retirement Debt

When retirement looms, financial stability is a gnawing concern for most people. Have I saved enough? What will inflation do to my nest egg? Will Social Security remain solvent? What are the health wildcards I haven’t planned for? As such, it’s wise to slash expenses and debt as much as possible, with the idea of entering retirement debt-free. For some, that means paying off the mortgage by accelerating their mortgage payoff.

Experian (https://bit.ly/3srAgU7) found that the average mortgage balance debt by generation in 2022 was:

Generation X (age 42-57): $274,406| Baby Boomers (58-76): $189,155 | Silent Generation (77+): $139,999

If you’re able to afford to put extra cash toward your mortgage, doing an early payoff can be a powerful strategy that not only cuts interest payments but lightens the financial and emotional load during retirement, bringing peace of mind, more money for hobbies, vacations, and funds for healthcare and long-term care expenses.

Still, before deciding, you must take a complete look at your financial picture to be sure that a faster payoff is the best way to achieve your goals and to understand the potential sacrifices and downsides of such a move.

Here are nine considerations.

1. Understand the risks. If you have a relatively low mortgage rate, could you miss out on higher returns on your money by putting the extra toward your mortgage? Will you miss out on mortgage interest deductions? By devoting money to your mortgage, you’re lowering your liquidity. Will that lack of liquidity adversely affect your other long-term goals or short-term needs? For example, are you hoping to give a chunk of money to help a child with a down payment or planning to pay some of your grandchild’s college costs?

2. Examine your debts. If you have credit cards, personal loans, and other obligations, paying those off is better before accelerating your mortgage payments. First, pay off debts with higher interest rates than your current mortgage because consumer debt typically carries higher interest rates than mortgages.

3. Understand your mortgage agreement. Read your agreement’s fine print and talk to your lender to be sure there aren’t prepayment penalties and that you’re allowed to make extra payments.

4. Calculate your savings. How quickly do you want to pay off your mortgage? Can you afford to shave five years or ten years off your mortgage? Use an online mortgage calculator to see how much principal you must pay every month or year to pay off a loan in a certain number of years and how much you’ll save with an early payoff. The savings can be significant. According to a NerdWallet calculator (https://bit.ly/45MhzZR), for example, if you took out a $300,000 30-year fixed loan at 5.5%, have ten years left, and decide to pay it off in five years, you’d have to pay an extra $206.75 monthly. The move would save $89,796.84 over the life of the loan.

5. Develop your repayment plan. Will you make an annual lump-sum payment or extra payments monthly or bi-weekly? One advantage of spreading the additional payments across the year and making bi-weekly payments is that you lower your principal balance each month, creating a smaller balance on which interest is calculated.

6. Look at your budget. How much extra money can you afford to put toward your mortgage? Where can you cut back? Also, consider the sacrifices you’ll need to make and decide if missing out on a vacation or cutting back on hobbies is worth it.

7. Don’t sacrifice retirement savings. Have an adequate emergency fund before shifting money to speed up your mortgage payoff. Also, be sure you’ll still be able to max out all your retirement vehicles like 401ks, Roth IRAs, and Health Savings Accounts and make catch-up contributions.

8. Pay the right way. Be sure to tell your mortgage holder that your extra payments will be applied to the loan principal, not the next month’s mortgage payment.

9. Talk to experts. Remember that there’s no one-size-fits-all approach with finances, so get advice from financial pros—your accountant and financial planner, for example—to understand the risks and the impact an early mortgage payoff would have on your other goals.

How do high interest rates affect the sale of your home?

Great question! High interest rates can indeed have an impact on the sale of your home. As a professional Realtor it’s essential for me to help you understand how interest rates can influence the housing market and the potential sale of your property.

- Reduced Buyer Demand: High interest rates can lead to reduced buyer demand in the housing market. When interest rates are high, the cost of borrowing money for a mortgage increases. This means that potential homebuyers may be discouraged from entering the market or may have to adjust their budgets, resulting in fewer qualified buyers looking for homes. As a seller, this could mean a smaller pool of potential buyers for your property.

- Decreased Affordability: Higher interest rates can also impact the affordability of homes for buyers. With higher mortgage rates, monthly mortgage payments increase, which could make it more challenging for buyers to afford the homes they desire. As a result, some buyers may have to lower their price range, leading to potential downward pressure on home prices.

- Extended Time on Market: The combination of reduced buyer demand and decreased affordability can result in homes staying on the market for a longer time. With fewer buyers and potential price adjustments, it may take more time to attract the right buyer at a price that aligns with market conditions.

- Impact on Home Prices: In areas where high interest rates are prevalent, we may see a moderation in home price growth or even a potential decline in prices. When demand decreases, sellers may find it necessary to adjust their listing prices to attract buyers, and this could lead to a softening of home prices in the market.

- Impact on Refinancing: For potential buyers who already own a home, high interest rates can also affect their ability to refinance their existing mortgages. This may lead to fewer homeowners putting their homes up for sale since they may be hesitant to lose their current low-interest rate by purchasing a new property with a higher mortgage rate.

As your real estate agent, I’ll keep a close eye on interest rate trends and how they impact the local market. If we find ourselves in a high-interest-rate environment, I’ll work closely with you to devise a pricing and marketing strategy that takes these factors into account. My goal is to position your home competitively in the market and attract qualified buyers to ensure a successful sale, regardless of the interest rate climate. Rest assured, my commitment is to help you achieve the best possible outcome in any market conditions

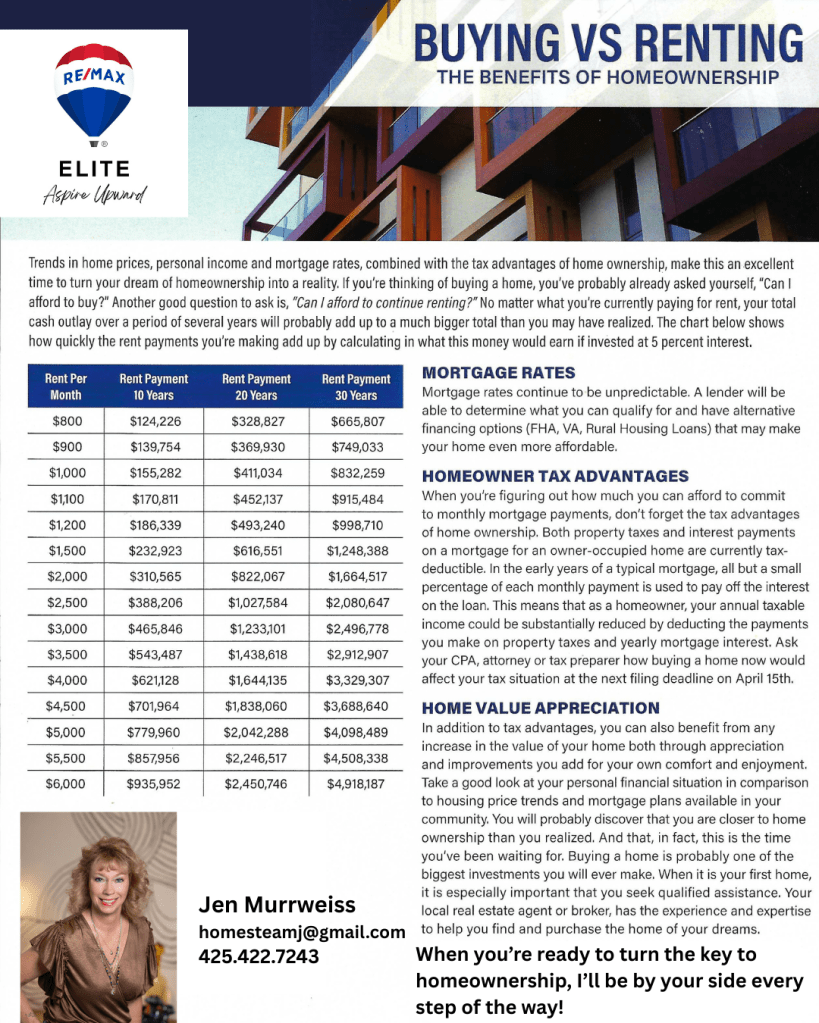

Home Prices Predicted To Explode! BUY NOW!

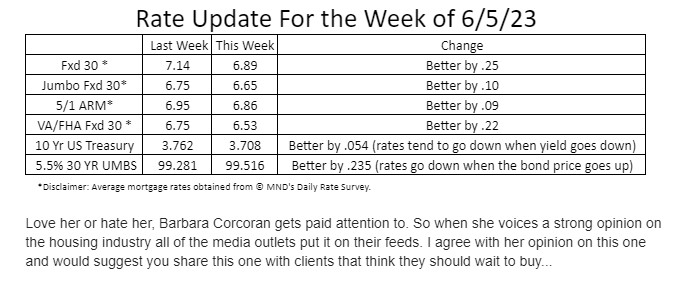

Self-made real estate millionaire Barbara Corcoran says it’s a ‘good time to buy’ because home prices are going to ‘explode’ when mortgage rates drop!

Alena Botros

Fri, June 2, 2023 at 2:00 AM PDT·4 min read

Appearing as a guest on Good Morning America this week, Barbara Corcoran answered several questions from viewers, ranging from when the right time to buy a home is to how to win a bidding war. As for the former, Corcoran said now is the time to buy.

“It’s a good time to buy because the minute interest rates go down, everybody’s waiting for them to go down even by a point, and when they do, they’re going to come rushing back in the market,” Corcoran said. “Prices are going to explode, and you’re going to be paying more for the same house. And you can always refinance, remember, when and if interest rates come down.”

It’s not Corcoran’s first time advising against even attempting to time the market. Previously, on the Chicks in the Office podcast, Corcoran said to forget about the timing, again stressing that now is always the time to buy.

The self-proclaimed “NYC Real Estate Queen,” founded the Corcoran Group with a $1,000 loan in 1973, which she famously turned into $66 million, after selling her business in 2001. She’ll always be a powerhouse within the real estate industry, but now most people know her as the spunky, blunt, and well-dressed shark on ABC’s Shark Tank.

Another viewer asked Corcoran how to win bidding wars, saying that he and his fiancee have been looking for a house but have been out bid every time they’ve found one they like. Corcoran said the key is to look like the “best deal in town,” while playing on the seller’s emotions.

“You have to be prequalified for your mortgage so you can go in there as an all cash deal. I’m an all cash deal, it’s not contingent, I already got my mortgage—you want that power behind you,” Corcoran said. “You also want to go in and realize it’s never just a financial deal. Get a nice piece of stationery and handwrite a note to that owner, and tell them how much you love the house. It makes a difference because people like to sell homes to people who love their house.”

As for the different types of mortgage loans that buyers can choose from, Corcoran said it depends on how long you’re going to live in that home. If you’re going to live there a long time, or at least except you are, Corcoran said a conventional rate mortgage at the shortest term you can afford, is the best option. On the other hand, if you’re only going to be living there for a short period of time, likely under five years, she said you’ll want to get an adjustable rate mortgage because it’s cheaper.

When Corcoran was then asked if there’s any way to get relief as someone who’s “house poor,” a term used to describe someone that’s spending more than 30% of their income on housing, she answered: “you don’t get relief from that.” In coastal cities, Corcoran said, people are spending more than 40% of their income on housing. But there’s a light at the end of the tunnel, in her view—people are forced to save by paying off their mortgage.

“When it comes time to retire, for most of us, it’s the only money we have to retire on,” Corcoran said.

Now if you want to make the most out of your home purchase, she said you’ll always get the best return in a high-traffic area. And if you want to make a killing, buy a home in an up and coming area. Corcoran’s formula for doing so? Follow the creative community and see where they’re living, and check out the nightlife.

And of course, a Corcoran Q&A couldn’t be complete without touching on rentals and renting. As for rent prices, Corcoran said they’re going to continue to go up, and there won’t be any relief. When interest rates go up and chase people into the rental market, rents generally go up. But when interest rates go down, that doesn’t mean rent follows. Corcoran said she’s never met a landlord that brings down their rent, ever. And, most of us know how she feels about renting—that it’s a “no-win game.”

This story was originally featured on Fortune.com

Remember~ date the rate, marry the home. As the famous Will Rogers said ” Don’t wait to buy real estate, by real estate and wait. Good advice everyone and I am just the gal to help you so reach out with all your real esate questions and needs in the Puget Sound region.

Has Real Estate Shutdown in Washington State?

I wanted to reach out to you today as I have been receiving many texts, calls and emails on how this outbreak maybe affecting the busy real estate season. This is a difficult time for all of us and the months ahead will bring uncertainty and challenges, of that, there is no doubt. This morning the owners of our five RE/MAX Elite offices had an online meeting with all of us to share the recent changes that the Northwest Multiple Listing Service (NWMLS) is advising based on social distancing, lowering the group threshold to 50 and best practices to protect our clients, ourselves and the public. We shared thoughts and ideas to keep working and helping our clients with their real estate needs but also to take action to keep everyone safe.

At the time the virus started to rear its ugly head there was a housing shortage. Meaning there were not enough homes for all the buyers that were currently looking. In the last month I have listed 3 homes with each one receiving multiple offers. The last home was two weeks ago, received double digit offers and a listing price that soared the final purchase to over $66,000 from listing price. That fact has not changed. We still are at low levels of inventory and in the last week I have seen homes come on the market and then sell in 3-5 days. I have three closing this week and while I know they are thankful, they are through the process, others are now very concerned what it may mean to them.

With that said in the last few days these are the most pressing questions I have been receiving regarding real estate. I hope I can shed a bit of light for you on what I know to be true currently.

What are interest rates, should I refinance?

Am I going to close on time?

Are open houses still going to be happening?

Should I wait to list or buy?

Sorry, this is long I will highlight the above question and try to answer the best I can with the information that is continually coming in.

Should I refinance now? I love how so many past clients and friends reach out to me with this question! While I am not a lender, I do try to read all the information coming in and what my preferred lenders are saying. When I am speaking to them I ask what they are seeing and what effects they are feeling. One of my preferred lenders, Duane Martin, at Caliber Home Loans indicated last week that they are inundated by those requesting refinancing. He mentioned that there may be a cap on refi’s right now and they may run out into 60 days to get completed. With so many wanting to refinance this is going to put a large strain on the lenders, title/escrow, appraisers and lending institutions. Home sales and purchase must be the priority.

So, to help answer questions, home mortgage interest rates did dip to a historically low rate and some were able to take advantage of this. They have since come back up to normal rates. This may change. They could go down again, rise or go higher. What you may be hearing more of right now are the interest rates for consumer debt being lowered. Another one of my lender colleagues, Jeff Tisdale from VIP Mortgage out of Tempe, AZ area states “The Fed Funds rate does NOT directly reflect in mortgage rates. The Fed rate impacts shorter term rates like credit cards, HELOCs, car loans, etc. Mortgage rates generally parallel the 10-year treasury bond. HOWEVER, there was a liquidity and volume issue due to the massive amounts of refinance volume, so rates spiked last week. We won’t know how this will affect mortgage rates until tomorrow and the coming days, weeks, etc. The industry can only take on so much at one time. Nobody truly knows what will happen, but I would expect continued volatility in the near future.

What is true is we are in uncharted territory and nobody knows what the short- or long-term effects of this will be.” Jeff goes on to say for anyone interested in refinancing or purchasing to get their application in with ALL supporting documents. The mortgage industry is beyond capacity right now and the complete files will get worked on first. The clients that need to be chased down for paperwork will suffer and wait.

Am I going to close on time? Our team has several clients that are scheduled to close the end of the month. Will we close on time? That is our goal. I am telling all of my clients that we are working behind the scenes to keep up with, and make sure, we work together quickly with Escrow/title your lender, insurance, mortgagor and all the other moving parts involved with a real estate transaction This is our goal! If we make sure all is in order beforehand and you are quick and diligent about getting any last-minute documentation requested into them we should. If, however, the county shuts down and there is no one to complete the transfer and recording process this very likely will delay homes closings.

There is that wish again for a crystal ball!

Are open houses still going to be happening? Well that changed very quickly. As of this morning they were advising to not have open houses but you could do one with limiting people through a few at a time, taking safety precautions and letting your seller decide based on if the home was vacant or occupied. After speaking with a seller this morning and coming up with a plan for them and their needs it has since changed. The NWMLS stated this afternoon they are disabling the Open House and Broker feature until the end of the month. What does this mean? Essentially no open houses. The consumer real estate sites are fed from the NWMLS. All the information on open houses regarding days, times, information and updates feed to sites like Zillow, Realtor.com, Redfin etc. If you go looking on Saturday morning for the open houses for the weekend you are not going to find any. I suppose there may be a rebel out there who puts up an open house sign in hopes that you are wandering aimlessly around and see their sign and say “Wow let’s go” but I doubt it.

Should I wait to list or buy? Of course, we have a huge concern for our clients many of whom we have been working with for months!

For sellers to get them to the point of selling its not always easy! If you have not sold a home you may not realize the time, energy, cost and all the prep work that goes into doing so. I have 2 sellers right now that I have been working with since September and one since August! We were going to be listing in April/May. So now what? We have some buyers and sellers that are moving on to their next adventure in life. Some are moving across country for jobs or family. Some are downsizing and some are looking for a different home to fit their family’s needs. There is so much thought that goes into buying or selling a home and our job is to direct them while keeping them moving forward to their goal. This service we provide to our clients prior to ever being compensated. Our advice, suggestions, referrals for contractors, lenders, timelines and helping them coordinate for their new home takes great thought, planning, experience and counseling. We want our clients to know that we will continue to do all we can to direct and guide them. If they have a job they have to be at here in Washington, or another state, then we move forward and help them buy or list their home when planned. If they are moving because they have a new home being built, and do not want 2 mortgages, or need to move to take care of a family member we move forward as planned the best way we can. For each client it’s going to be a different scenario.

When you’re selling a home exposure is key. The more potential buyers see your home and feel themselves living in it the more likely you will get an offer. If we are limited on showings, open houses, Brokers opens, advertising then it will affect the entire experience and days on market will be longer. That is a determination that each needs to make based on their future goals. If, by chance, your kids are now home with you and that idea of decluttering and packing while they were at school has now turned into home-schooling then well, we may have to re-adjust your goal.

For our buyers you may be looking on line but you need to see the home and feel how you would flow in it and make sure it meets your needs. This is very difficult to do without physically viewing and we want you to know that Britt and I will be available for private showings at this time, and as the needs arise, if the home allows it.

It will be okay and together we can do it! We need to go with the flow but flow we must. I feel the worst thing we can do is just freeze and not move forward. Yes, we may be hitting the pause button for a bit but, we must move forward.

Please remember during this time of uncertainty, I want you to know that we are thinking of you and will do whatever we can to support our clients and their goals. Yes, this outbreak is very scary, but we can’t let it dismantle our economy. Small businesses will suffer and there will be effects down the road that will affect us all. We need to be caring and do all we can to support/shop local.

Please don’t live in fear. Be smart, stay safe, stay healthy and keep in touch.

I would be happy to go into this deeper with anyone that has questions.

Feel free to reach out!

Jen Murrweiss and Britt Maltos

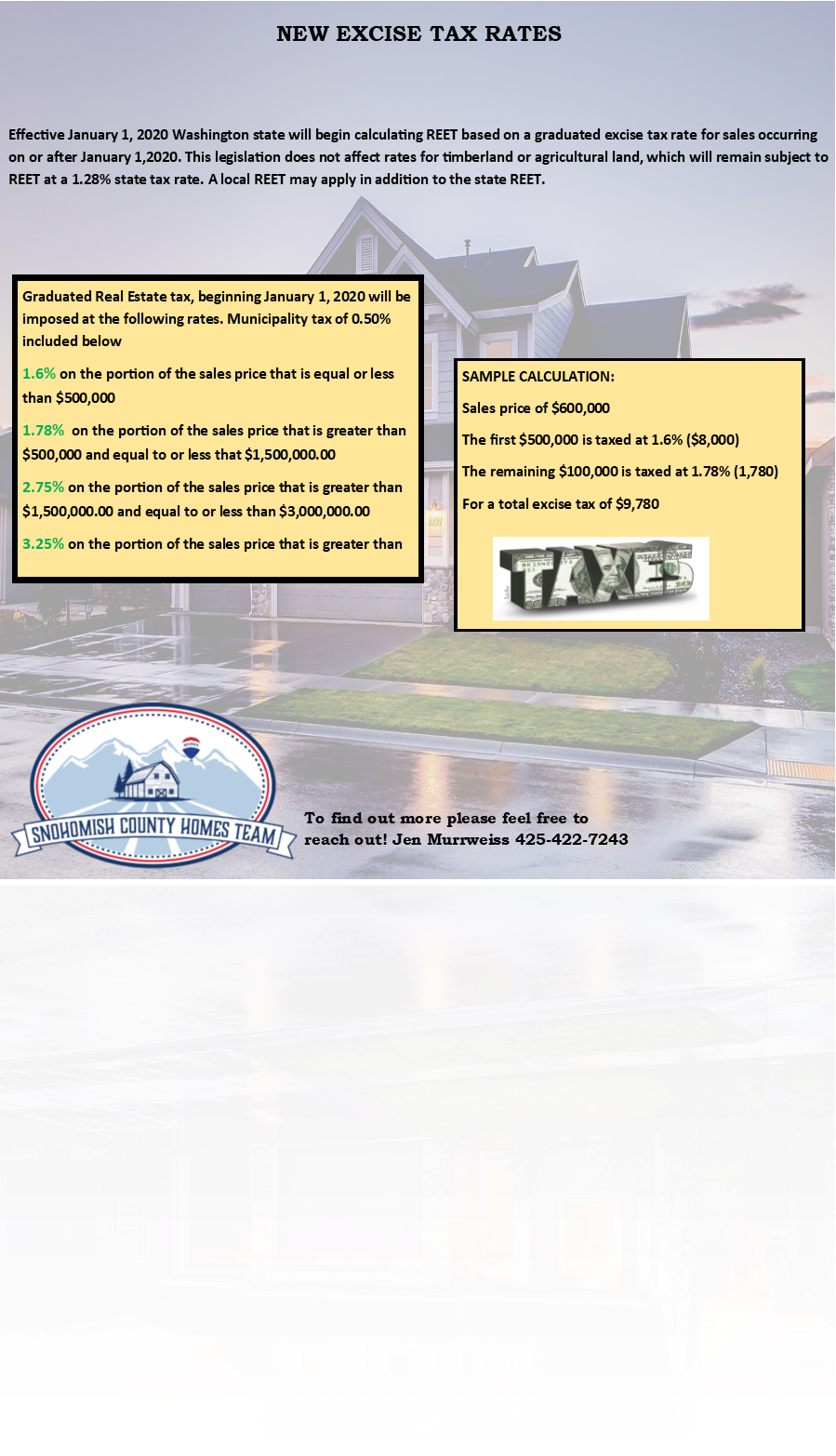

New Excise Tax Rates

The Home Connection for September

Wire Fraud in on the rise

If you are refinancing, purchasing or selling this is a must read. I tell all my clients to call me first and double check if they get any suspicious email or phone call. Do not let this happen to you!

Real Estate news you can use!

Check out these articles for great information about our community and the real estate industry.

New home sales hit highest level in 9 years!

Millennials still believe in the homeownership dream even if they can’t afford to buy

Housing market across the U.S. finally starting to look healthy

MORTGAGE & FINANCE news

Salary needed to buy a home in 19 major U.S. cities

Tips for staying out of debt

Calculate how much house you can afford

HOME trends

King County’s eco-remodeling tool provide tips for going green for your next home renovation

Four colors that may hurt a home’s sales price

LOCAL news

7 percent of Puget Sound homes are underwater, compared with 12 percent nationally

A teardown a day: Bulldozing the way for bigger homes in Seattle, suburbs

BLS stats show Seattle-Tacoma-Bellevue is #7 Metro area for fastest job growth

What does Vancouver’s housing market implosion mean for Seattle?

Seattle home-sale market provides small hint of slowdown

You need an annual salary of $83K to afford a home in Seattle

Everett welcomes the film industry, an important economic driver for local businesses

WEEKLY DOSE OF awesomeness

Happy 100th Birthday U.S. National Parks

I hope your week is a great one!

Jen Murrweiss | Remax Elite | 425-422-7243

Snohomish County Statistics for November

Snohomish County Statistics as of November 30 2015

Active Inventory

Down -29% November 2015 vs. November 2014

2125 available homes currently on market -700 vs. last month.

Pending Transactions

Up 30% November 2015 vs. November 2014

1513 units -200 vs. last month

Sold Transactions

+11% November 2015 vs. November 2014

1139 units -600 than last month

Days on Market

Snohomish County Active to pending 47 days vs. 55 a year ago up 3 day from last month.

Median home price in Snohomish County 350,000 +5% last year. -12,000 from last year.

Area price % based on last Quarter

Bothell + 6%, Edmonds/Lynnwood +11%. Everett/Mukilteo +5%

Snohomish/Monroe + 11%. Lake Stevens/Granite Falls -2 %.

Marysville +10%