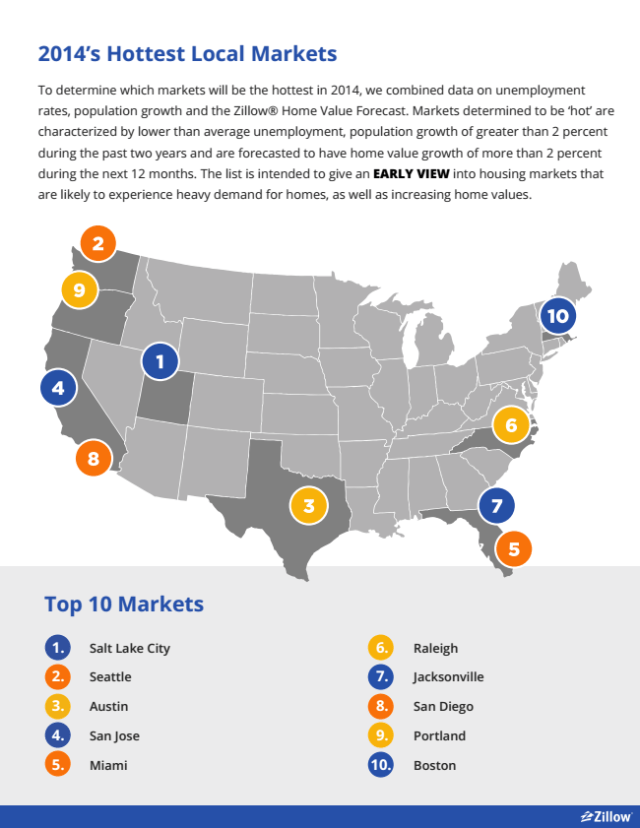

The market is heating up and even though I don’t always agree with Zillows “Zestimates” I do believe they are very accurate about the predictions for 2014 Housing Market. Rates are going up! My advice to those that are waiting to buy a home? If you are seriously thinking this year as they year~ start looking sooner than later. If you also take a look here in the Puget Sound Region we are #2 for the hottest market areas. All over its HOT and especially in Snohomish County. In the last week I have put in a total of 6 offers for clients and all were multiple offer situations. Knowing the tricks to secure the home you want over all the other offers take an experienced agent that will due their due diligence. If you need help please feel free to contact me!

Tag Archives: Bothell Real Estate

US. Housing Price Appreciation and Real Estate News

Real Estate News

In 2013, the housing markets with the biggest increases in asking prices were all rebounding from severe price drops in the housing bust. Home prices are still in rebound mode, but this effect will weaken in 2014. Job growth, in contrast, mattered little for price gains in 2013 but helped drive rent increases.

In December, the year-over-year increase in asking home prices slowed for the first time since the price recovery began in early 2012: prices rose 11.9% year-over-year in December, compared with November’s 12.2% year-over-year increase. Asking prices rose 0.4% month-over-month, seasonally adjusted, the third straight month of gains less than 1%.

Overall, regression analysis shows that recent price gains are most strongly associated with the severity of the local housing bust. Markets where prices fell most during the bust (roughly 2006 to 2011, but varies by metro) offered bargains for investors and other buyers who have helped bid prices back up over the past two years. A second important factor is foreclosures: adjusting for other factors, metros with a higher foreclosure inventory today – including many in Florida – have slower price growth. Job growth, however, had little impact on local home price gains in 2013: the relationship between job growth and price gains was positive but not statistically significant.

Therefore, year-over-year price gains in December 2013 are still primarily a reaction to the housing bust, but this rebound effect is fading as we enter 2014. Looking at the quarter-over-quarter price changes throughout 2013, the relationship between the severity of the housing bust and the recent price recovery was stronger earlier in the year than later in the year. More specifically, the correlation between peak-to-trough price change (FHFA) and the Trulia Price Monitor quarter-over-quarter change was -.59 in March; -.45 in June; -.43 in September; and -.33 in December. This correlation is moving closer to zero, which signifies that the rebound effect is fading. As the housing market continues to recover, factors other than the rebound effect – like job growth – will matter more for price gains. That means slower but more sustainable price increases.

Note: These asking prices are SA (Seasonally Adjusted) – and adjusted for the mix of homes – and this suggests further house price increases, but at a slower rate, over the next few months on a seasonally adjusted basis.

From Trulia chief economist Jed Kolko: The Post-Crash Rebound, Not Job Growth, Drove 2013 Price Gains

Interactive Chart

Please take a look at this great interactive PDF with a map and average home price appreciation info for the entire United States by clicking through to this link, you’ll find the US Map and much more state specific data in an interactive version.

We hope you find this information useful and never hesitate if you would like to see more or would like more information.

http://www.snohomishcountyhomes4u.com

Christmas Fun!

Countdown to Christmas Day 19

Saturday, December 7

“Santa’s Coming to Mill Creek” Parade followed by Tree Lighting at City Hall Mark your calendars for Saturday, Dec 7, 2013 and please join Rotary of Mill Creek, Mill Creek Town Center & Mill Creek Parks & Recreation for the annual Parade/Tree Lighting at City Hall & Town Center Celebration.

This Saturday, December 7th, Santa is coming to the Mill Creek Town Center!

And dont forget after to check out the Tree lighting Event

Mark your calendar and please join Rotary of Mill Creek and Mill Creek Parks & Recreation for the annual Parade & Tree Lighting in Town Center. Parade begins at 3:30 pm on Main Street followed by the annual Tree Lighting at City Hall. A few highlights from the event include live music, performances by Jackson High School Drumline, Dickens Carolers, Cookie Decorating, Carriage & Wagon Rides, Train Rides, Santa & his Elves and even live Reindeer. Photo opportunities with Santa in Town Center following the Parade & Tree Lighting event – bring your cameras and add to your family memories.

Then come to our office (Remax Town Center) We will host a gingerbread house coloring contest from 4-7pm. Children can come in and Gingerbread Houses and join the contest! We will help them place their pictures in the window for display. A hot chocolate station and coffee station will be set up for refreshments.

Hope to See you there!

Location: North end of Main Street and end at Mill Creek City Hall

For more information, please visit: the City”s website at www.cityofmillcreek.com

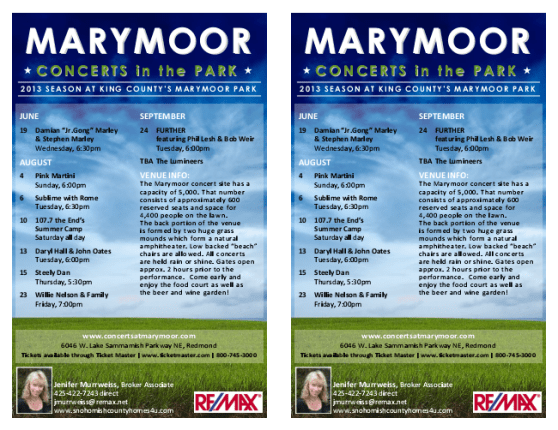

Summer Time Means Some Great Concerts

2013 Summer Events

Competition among home buyers Fierce!

News from NW Multiple Listing Service

FOR IMMEDIATE RELEASE: June 5, 2013

Competition among home buyers “still fierce;” rising interest rates adding to fury

NWMLS, Kirkland, WA, June 5, 2013 – Well-priced homes continue to draw multiple offers and sell at a brisk pace around Western Washington as buyers react to increases in interest rates and asking prices.

Northwest Multiple Listing Service reported double-digit gains in several key indicators it tracks for the 21 counties in its service area. Compared to a year ago, the number of new listings climbed 16 percent, pending sales increased about 10 percent, closed sales jumped nearly 22 percent, and prices rose more than 13 percent. Despite gains in listing activity, inventory remains tight.

Commenting on the latest report, brokers said the fast pace is frustrating some buyers — and surprising sellers with unrealistic expectations. One broker cautioned against an overheated market. “We do not want a market that escalates too fast and topples again,” commented Frank Wilson, Kitsap district manager at John L. Scott Real Estate and branch managing broker for its Poulsbo/Kingston office.

“Overly aggressive sellers find themselves disappointed when no or low offers are presented,” remarked Northwest MLS director Kathy Estey, the managing broker at John L. Scott in downtown Bellevue.

With inventory apparently improving, some would-be buyers are staying on the sidelines. The increased inventory is “cooling some buyers,” reported George Moorhead, managing broker at Bentley Properties in Mill Creek and a member of the MLS board of directors. “We also have buyers who are stepping back as they are frustrated with current inventory and multiple offers going well above asking price,” he added.

Inventory showed signs of improving with the addition of 11,445 new listings during May, the highest number since April 2010. May’s total outgained the year-ago figure of 9,861 new listings for a 16 percent gain.

“It has been refreshing to see more listings coming on the market, but with overall inventory remaining low the competition among buyers is still fierce for homes that are priced properly,” commented Estey.

At month end, there were 21,943 total active listings in the Northwest MLS database, a drop of 4,248 from the same time a year ago for a decline of more than 16 percent.

Buyers looking for condominiums will find slim pickings. Condos currently account for only about 10 percent of the available inventory. The area-wide selection, which numbers 2,253 listings, is down more than 26 percent from a year ago.

Brokers reported nearly as many pending sales system-wide (10,045) as new listings (11,445). Nine counties reported year-over-year gains in pending sales that exceeded 30 percent (Clallam, Cowlitz, Ferry, Grant, Grays Harbor, Island, Kitsap, Lewis, and Okanogan).

Most metro area counties had more modest gains in pending sales: King (up 6 percent) Snohomish (down 5.8 percent) and Pierce (up 10.6 percent).

Closed sales continue to track well ahead of a year ago. During May, members tallied 7,349 completed transactions, outpacing the year ago total of 6,027 by nearly 22 percent.

Prices jumped 13.4 percent from twelve months ago, rising from an area-wide median selling price of $242,500 to last month’s price of $275,000. The median price for homes and condos that sold in both King County and San Juan County was $375,000 ($100,000 higher than the area-wide figure). In King County, that represented a gain of 15.4 percent, while for San Juan County prices edged up only about 1.8 percent compared to a year ago.

“We’re seeing the trajectory of home prices beginning to soften and the number of days on the market decline,” observed Mike Grady, president and COO of Coldwell Banker Bain, adding, “The trends suggest inventory levels are slightly more sustainable, but we’re still clearly in a seller’s market. For the foreseeable future, buyers will continue to pay more the longer they wait to purchase a home.”

Frank Wilson, who is also a board member for Northwest MLS, said recent market activity is affecting home values. In Kitsap County, where his office is located, brokers added 575 new listings to inventory during May, improving on the year-ago total of 515. During the same period, MLS members reported 567 pending sales to soar past the year ago figure of 414 sales for an increase of nearly 40 percent. Median selling prices in Kitsap County rose 5.3 percent, from the year-ago figure of $228,000 to $240,000.

“Slow and steady is the key here,” Wilson cautioned, while also raising concern about low appraisals, which he described as the “inchworm effect” of the market. “As prices begin to appreciate we will continue to see challenges with low appraisals,” he predicted.

Moorhead said increased activity is very noticeable, with mixed outcomes. “We are seeing multiple offers at 5-to-12 percent over list price in highly sought-after areas,” he reported, but also noted “there are other homes on the market that are not selling with no real reason why.”

Some brokers also commented on rising interest rates.

Wilson said the biggest effect of the upswing in the real estate market has been the erosion of a buyer’s buying power. In May alone, interest rates jumped almost 0.75 percent, he noted, which reduces a buyer’s ability to purchase a $350,000 home by almost $31,000. Coupled with an increase in price, he said it “creates a compounding affect, which will frustrate buyers in today’s market.”

Estey said interest rate increases are “adding fury to the already frenzied buyers who must finance their purchase.” A one-half percentage point increase in interest rates reduces buying power by 5 percent, she explained, adding, “so as prices increase about a percentage a month, the feeling of urgency mounts too.”

Commenting on the challenges buyers are encountering, Estey said, “The joy of buying a home in today’s market is in the long-term result of settling in, but the competitive process is sometimes not so joyful! Hiring the right broker who can add some fun elements and insights while wisely guiding buyers through the decision process can make a huge difference,” she suggests.

Federal officials are downplaying rising interest rates. In a recent interview, Frank Nothaft, Freddie Mac’s chief economist, commented on the latest rise that marked three consecutive weeks of increases. “While this may slow some of the refinance momentum, rates are nonetheless low and home-buyer affordability high, which should further aid home sales and construction in coming weeks,” he remarked, adding, “The rates are also lower today than they were a year ago at this time.”

Northwest Multiple Listing Service, owned by its member real estate firms, is the largest full-service MLS in the Northwest. Its membership includes more than 21,000 real estate brokers. The organization, based in Kirkland, Wash., currently serves 21 counties in Washington state.

###

Statistical summary and sources quoted follow.

Statistical Summary by Counties: Market Activity Summary – May 2013

| Single Family Homes + Condos |

LISTINGS | PENDING SALES |

CLOSED SALES | MONTHS SUPPLY |

|||

| New Listings |

Total Active |

# Pending Sales |

# Closings |

Avg. Price |

Median Price |

||

| King |

4,352 |

4,832 |

4,041 |

3,122 |

$457,903 |

$375,000 |

1.20 |

| Snohomish |

1,564 |

1,777 |

1,487 |

1,131 |

$309,112 |

$285,000 |

1.20 |

| Pierce |

1,576 |

3,025 |

1,648 |

1,116 |

$234,875 |

$210,000 |

1.84 |

| Kitsap |

575 |

1,426 |

567 |

345 |

$286,870 |

$240,000 |

2.51 |

| Mason |

206 |

759 |

94 |

71 |

$178,045 |

$149,900 |

8.07 |

| Skagit |

245 |

785 |

226 |

149 |

$238,902 |

$220,020 |

3.47 |

| Grays Hrbor |

165 |

807 |

114 |

68 |

$143,411 |

$139,000 |

7.08 |

| Lewis |

187 |

700 |

90 |

74 |

$150,977 |

$134,500 |

7.78 |

| Cowlitz |

164 |

455 |

134 |

83 |

$174,330 |

$169,000 |

3.40 |

| Grant |

145 |

547 |

92 |

76 |

$169,412 |

$157,840 |

5.95 |

| Thurston |

506 |

1,121 |

482 |

332 |

$241,093 |

$225,500 |

2.33 |

| San Juan |

67 |

415 |

25 |

19 |

$519,047 |

$375,000 |

16.60 |

| Island |

279 |

834 |

199 |

117 |

$281,624 |

$240,000 |

4.19 |

| Kittitas |

150 |

447 |

66 |

60 |

$285,393 |

$217,995 |

6.77 |

| Jefferson |

123 |

466 |

53 |

40 |

$308,200 |

$298,750 |

8.79 |

| Okanogan |

114 |

447 |

48 |

28 |

$193,686 |

$147,950 |

9.31 |

| Whatcom |

552 |

1,448 |

398 |

279 |

$290,196 |

$250,000 |

3.64 |

| Clark |

83 |

149 |

69 |

54 |

$255,812 |

$229,000 |

2.16 |

| Pacific |

91 |

436 |

36 |

27 |

$136,736 |

$121,000 |

12.11 |

| Ferry |

11 |

76 |

4 |

5 |

$139,600 |

$151,000 |

19.00 |

| Clallam |

104 |

415 |

68 |

62 |

$191,923 |

$181,000 |

6.10 |

| Others |

186 |

576 |

104 |

91 |

$217,902 |

$179,900 |

5.54 |

| MLS TOTAL |

11,445 |

21,943 |

10,045 |

7,349 |

$343,639 |

$275,000 |

2.18 |

4-County Puget Sound Region Pending Sales (SFH + Condo combined)

(Totals include King, Snohomish, Pierce & Kitsap counties)

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2000 | 3706 | 4778 | 5903 | 5116 | 5490 | 5079 | 4928 | 5432 | 4569 | 4675 | 4126 | 3166 |

| 2001 | 4334 | 5056 | 5722 | 5399 | 5631 | 5568 | 5434 | 5544 | 4040 | 4387 | 4155 | 3430 |

| 2002 | 4293 | 4735 | 5569 | 5436 | 6131 | 5212 | 5525 | 6215 | 5394 | 5777 | 4966 | 4153 |

| 2003 | 4746 | 5290 | 6889 | 6837 | 7148 | 7202 | 7673 | 7135 | 6698 | 6552 | 4904 | 4454 |

| 2004 | 4521 | 6284 | 8073 | 7910 | 7888 | 8186 | 7583 | 7464 | 6984 | 6761 | 6228 | 5195 |

|

2005 |

5426 | 6833 | 8801 | 8420 | 8610 | 8896 | 8207 | 8784 | 7561 | 7157 | 6188 | 4837 |

|

2006 |

5275 | 6032 | 8174 | 7651 | 8411 | 8094 | 7121 | 7692 | 6216 | 6403 | 5292 | 4346 |

|

2007 |

4869 | 6239 | 7192 | 6974 | 7311 | 6876 | 6371 | 5580 | 4153 | 4447 | 3896 | 2975 |

| 2008 | 3291 | 4167 | 4520 | 4624 | 4526 | 4765 | 4580 | 4584 | 4445 | 3346 | 2841 | 2432 |

| 2009 | 3250 | 3407 | 4262 | 5372 | 5498 | 5963 | 5551 | 5764 | 5825 | 5702 | 3829 | 3440 |

| 2010 | 4381 | 5211 | 6821 | 7368 | 4058 | 4239 | 4306 | 4520 | 4350 | 4376 | 3938 | 3474 |

| 2011 | 4272 | 4767 | 6049 | 5732 | 5963 | 5868 | 5657 | 5944 | 5299 | 5384 | 4814 | 4197 |

| 2012 | 4921 | 6069 | 7386 | 7015 | 7295 | 6733 | 6489 | 6341 | 5871 | 6453 | 5188 | 4181 |

| 2013 | 5548 | 6095 | 7400 | 7462 | 7743 |

__________

Copyright © 2013 Northwest Multiple Listing Service

ALL RIGHTS RESERVED

This material may not be copied, published, broadcast, rewritten or redistributed without prior permission.

Welcome June and To The Home Connection Newsletter.

Why Pay A Real Estate Commission??

Considering selling your home by yourself?

Is it worth it?

Only the home owner can answer that question but experience has shown that many for-sale-by-owners find that it’s not. Before making a costly mistake plus an astronomical amount of time and wasted energy consider the benefits, from A to Z, you receive from working with a Real Estate Professional:

Advertising– We have proven marketing strategies to get you the best exposure and your agent should be rocking out the info on your home non-stop.

Bargain– research shows that 77% of sellers felt their commission was “well spent.” For the other 33% I say they should have gotten another agent. We must work for you to reach a common goal for all! Look I don’t get paid if I don’t do my job and sell your house period. So why would I not want to do my best?

Contract Writing– An agent can supply the standard forms that are written by lawyers to protect all parties in the transaction which in turn speeds things up. If you sell by yourself you need to hire a lawyer to draw up the docs. How much does that cost?

Details– There is millions of them trust me. An agent frees you from handling the many details of selling a home. Getting an offer is the easy part holding the transaction together after is where the details really count.

Experience and Expertise– In marketing, financing, negotiation and more. If your agent does not get another one!

Financial Know How– An agent is aware of the many options for financing a sale and can make sure you home qualifies for as many as possible to open up the buyer pool.

Glossary- A real estate professional understands, and can explain, real estate lingo

Homework- Agents are informed through research and experience, an agent will know your market and the areas they work in daily.

Information– If you have a real estate question and agent will know (or can get the answer)

Juggle showings– We agents handle all showings and the 10 phone calls of anxious buyers who want to be the first one to get in and see.

Keep your best Interests in mind– It’s our job! Selling you home is emotional and you need to trust your agent with information to help them help you.

Laws– A real Estate professional will be up-to-date in real estate laws that affect you.

Multiple Listing Service– Our number one tool to get your home out there to over 5,000 agents with potential buyers. Bringing you both together.

Negotiation– An agent can handles all price and contract negotiations.

Open Houses– A popular marketing technique that gives you exposure.

Prospects– Our network is huge and with reverse prospecting we know what other agents are looking for. In turn helping to produce potential buyers.

Qualified Buyers– You don’t need any looky-loos you need Pre-approved buyers period or if cash proof of funds. We make sure that is the case.

Realtor- An agent who is a member of the National Association of Realtors and subscribe to a strict code of ethics.

Suggested Price– An agent will do a market analysis to establish a fair price range. I also go a step further and visit other for sale properties in the area to for competition and how we can stand out from the crowd.

Time- How much time are you willing to put into selling on your own? Believe me it can be huge and its one of the most valuable resources that an agent can provide.

Unbiased Opinion– Most owners are too emotional about their home to be objective. Of course they are! They have lived there, raised their kids, remodeled and have many memories. Someone wanting to buy your home has none of that and honestly does not care. It’s what is in it for them and if it fits their needs. This is one of the hardest thing a home-owner needs to do is emotionally remove themselves from their home. Stand back and look at it from stranger’s eyes. Not an easy task!

VIP– That’s how you will be treated by your agent and if not get another one! No excuse… period.

Wisdom- A knowledgeable agent can offer the wisdom that comes with experience.

X Marks the spot– An agent is right there with you through the final signing of papers and can help you coordinate moving plus so many things you may have never thought about.

Zero-Hour Support– We are there to support you!

Happy Buyer in Bothell

Ryan Client, Buyer

Ryan Client, BuyerJenifer knows how to take care of her clients. My wife and I saw about 15 properties with Jennifer before we found our new house. Throughout the whole process Jenifer was timely in her responses/updates. In the beginning part of the home buying process, the sellers initially agreed to have the HVAC system clean out. Then towards the end the sellers changed their minds and would not have the cleaning done. Jenifer went above and beyond and paid for the cleaning herself since she knew how important it was to our family and Jenifer did not have to do that. Now that we have our new house, Jenifer is selling our condo and I would recommend her to anyone! Thanks Jenifer!

The New Normal??

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||